Tata Mutual Fund has introduced the Tata Nifty India Tourism Index Fund. This new scheme is available for public subscription from July 08, 2024. It is open for subscription till July 19, 2024. After this period, it will reopen for continuous sale and repurchase from July 29, 2024.

Scheme Details

The Tata Nifty India Tourism Index Fund is an open-ended equity scheme. It focuses on the tourism sector in India. According to Anand Vardarajan, Chief Business Officer at Tata Asset Management, the scheme aims to benefit from the rapid growth in domestic travel and tourism. He shared the significant improvements in infrastructure, such as highways, railways and airports. These have made travel easier and more accessible for everyone.

Also Read | ‘Aditi’, an affordable health insurance by Narayan Health: Check how this can revolutionize insurance sector

Investment Objective

The main aim of this fund is to provide returns that match the performance of the Nifty India Tourism Index (TRI). This is before all the expenses and inconsideration of the tracking errors. However, there is no guarantee that the fund will achieve its investment objective. It does not promise any specific returns.

Economic Context

The launch of this fund comes at a time when the Indian economy is strong. This strength is due to the high levels of investment and consumption. The growing middle class in India is spending more on travel. Given the better infrastructure and increased air travel options, people’s travel choices and needs have increased.

How to Invest

Investors can start investing in this scheme with a minimum amount of INR 5000. with additional investments in multiples of INR 1. There is no maximum limit on the amount that can be invested.

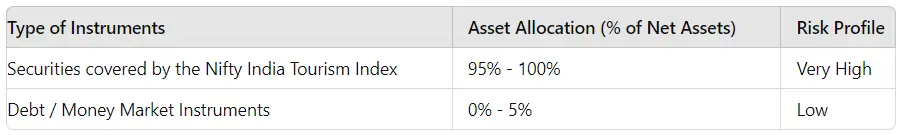

Asset Allocation

Investment Allocation

The fund will primarily invest in:

- Equity and equity-related instruments

- Debt and money market instruments

- Units of domestic mutual funds

Unique Fund Offering

This is a unique fund. No other asset management company has launched a fund specifically targeting the tourism sector in India.

Benchmark Performance

The fund’s performance will be benchmarked against the Nifty India Tourism Index Fund (TRI). The fund will primarily invest in securities that are part of this index.

Entry and Exit Loads

There is no entry load for this scheme. Thus, the investors do not have to pay a fee to invest. However, there is an exit load of 0.25% of the applicable NAV, if redeemed within 15 days from the date of allotment. This exit load will be credited to the scheme after deducting Goods & Services Tax (GST).

Also Read | “Bajaj Ki Guarantee” For World’s First CNG Motorcycle: Freedom 125 For The Independent India

Fund Manager

The scheme will be managed by Kapil Menon. He will oversee the investments and strategy of the fund.

Risk Consideration

This scheme is categorized as “Very High Risk.” It is suitable for investors who understand that their principal amount is subject to very high risk. This new fund offers an opportunity for investors to capitalize on the growing tourism sector in India. It is backed by significant infrastructure improvements and increasing travel demand.

Disclaimer

The content of this article is only for informational purposes and we do not offer any investment advice from our end. Please consult a SEBI-registered investment advisor before making any investment decision. The information does not necessarily reflect the views/opinions of the publisher.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.