Erode-based dairy company Milky Mist was founded by school dropout T Sathish Kumar. Now, it is preparing for an initial public offering (IPO) with a target valuation of INR 20,000 crore. Milky Mist, known for its paneer and ice cream products, aims to expand its product range and compete with larger rival Amul.

Growth and Expansion

Milky Mist ended FY24 with a turnover of INR 2,000 crore and a profit of around INR 50 crore. Despite its significant growth, discussions to raise private funding from WestBridge fell through last year. Instead, the company is focusing on going public to fuel its expansion plans. This includes new product offerings like chocolates and ice creams.

Also Read | Kotak Mahindra Bank Pulled in Adani-Hindenburg Controversy

Founder’s Journey

T Sathish Kumar started Milky Mist in 1985 as a milk trading company and shifted to producing paneer in 1994. Over the years, the company has grown to include products such as curd, butter, cheese, yogurt and ice cream. Kumar, along with his wife Anitha Sathish Kumar and CEO K Rathnam, who was previously managing director at Amul Dairy, has built a strong brand in the dairy industry.

IPO Strategy

Milky Mist has been in talks with major investment and merchant banks like Kotak, HDFC, Nuvama, 360 One, and Axis to explore the IPO route. CEO K Rathnam confirmed that the company does not plan to raise money from private investors but will instead go public. This decision follows multiple unsuccessful attempts to raise private capital in the past decade.

Funding Challenges

Despite coming close to securing private funding on several occasions, Milky Mist faced challenges due to the promoter’s reluctance to give up control to outside investors. However, the company managed to secure a bank loan of around INR 450 crore from a consortium of banks. This includes Bank of Maharashtra, Indian Overseas Bank, Union Bank and RBL. This loan came with an interest subvention, effectively reducing the interest rate to 6%.

Financial Performance

Milky Mist saw significant revenue growth in FY23. There was a 42% increase from the previous year. The company reported a revenue of INR 1,437 crore in FY23 and a profit of INR 28 crore. By FY24, revenue had grown to around INR 1,950 crore. It had a profit of INR 50 crore. Milky Mist aims to achieve a valuation similar to its peer Hatsun Agro. It has a market capitalisation of around INR 25,000 crore.

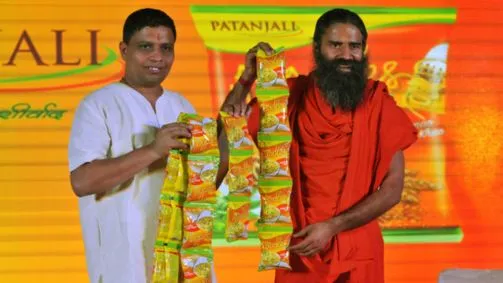

Also Read | Patanjali Foods shall Acquire Non-Food Business of Patanjali Ayurved for INR 1,100 Crore

Future Plans

Milky Mist plans to expand its presence in northern, western and other regions of India. They are aiming to challenge Amul’s dominance in the dairy market. The IPO will help boost its visibility and support its growth into new markets. This will position Milky Mist as a strong competitor in the industry. The company targets an IPO no later than 2026.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.