On July 23, 2024, Securities and Exchange Board of India [SEBI] revealed in its recent study that a significant number of young traders are losing money in intraday trading. Specifically, 76% of these loss-making traders are under 30 years old.

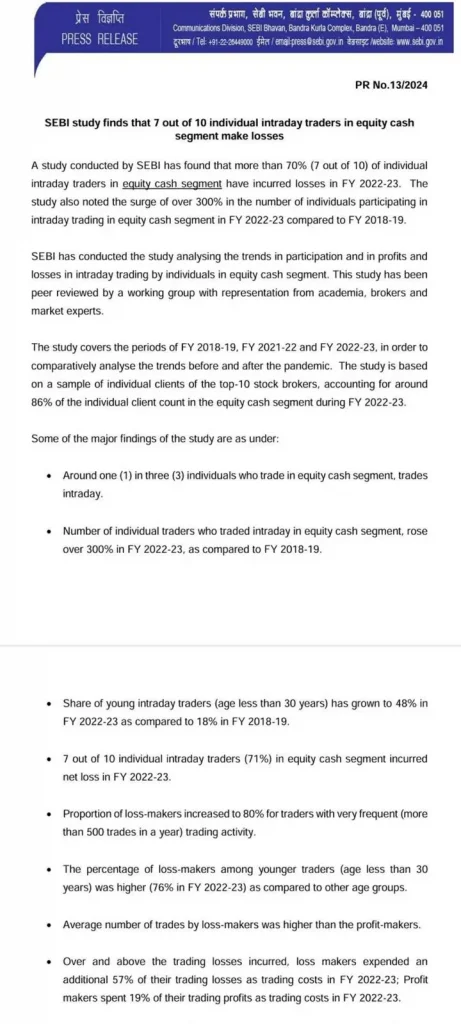

High Loss Rates in Intraday Trading

The study shows that, during FY23, seven out of ten intraday trades in the cash segment resulted in losses. Among the younger demographic actively participating in these trades, this high loss data is very concerning.

Rising Participation Among Young Traders

From FY19 to FY23, the share of under-30 intraday traders in India’s stock markets increased from 18% to 48%. However, the study showed that the younger the trader, the higher the likelihood of incurring losses.

Loss Rates by Age Group

The study found that traders under 20 years old had the highest proportion of losses at 81%. Those over 60 had the lowest proportion of losses at 53%. This indicates a trend where younger traders are more prone to making losses in intraday trading.

Challenges for Individual Traders

Abhishek Kumar, a registered investment adviser and founder of Sahaj Money, said in an interview that the individual traders face challenges in intraday trading. The main reason for the same is the financial institutions’ high-frequency trading mechanisms. These institutions often capture the arbitrage opportunities that were previously available to individual traders.

Trading Activity and Loss Aversion Bias

Manuj Jain, CFA, co-head of product strategy at WhiteOak Capital AMC, showed a positive correlation between higher trading activity and loss-making. He explained that traders who incur losses often engage in more trades to avoid the emotional discomfort of those losses. They mostly carry out these trades without proper analysis or strategy.

Previous SEBI Study on Derivatives Trading

Harsh Roongta, founder of Fee Only Investment Advisers LLP, mentioned that a previous SEBI study highlighted the risks of derivatives trading. There 90% of traders made losses. Despite these findings, derivatives trading volumes have increased.

Potential Impact of the Study

Roongta suggested that, like the earlier study, the current findings may not lead to immediate changes. He emphasized the need for a multi-pronged solution, including tighter regulations, higher taxes and behavioural interventions. These are very similar to anti-smoking campaigns.

Details of the SEBI Study

The SEBI study was conducted by the Department of Economics and Policy Analysis. They covered intraday trading in the cash segment during FY19, FY22 and FY23. It found that the number of individual intraday traders using the top 10 brokers increased from 1.5 million in FY19 to 6.9 million in FY23. However, 71% of these traders were loss-makers.

Also Read: Budget 2024: Government Unveils GST Expansion, Duty Cuts on Essentials and Simplified Tax Regime

Gender and Marital Status Findings

The study also noted a decline in the share of female traders from 20% in FY19 to 16% in FY23. Even though their share had been declining, but female traders had a higher proportion of profit-makers compared to males. Married traders had a higher proportion of profit-makers than single traders across all three years of the study.

Profit-Makers in Different Cities

Across 13 sample cities, the study found that the proportion of profit-makers was highest in tier I cities. This was followed by tier II and tier III cities.

SEBI Study:

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.