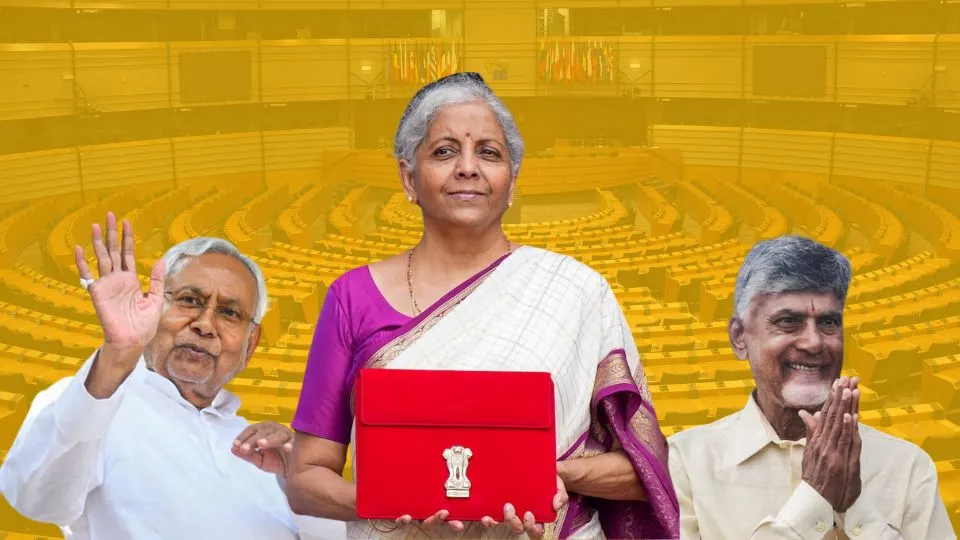

Sonal Varma, Managing Director and Chief Economist, Nomura Financial Advisory and Securities India, and Pranjul Bhandari, Chief Economist, HSBC India, believe that post-election, monetary policy meeting is crucial. This is especially true in areas such as capital expenditure, fiscal consolidation, and macro-financial stability.

GDP growth surpassed predictions: 2023 – 24

Ms Varma stated that Nomura raised its GDP growth forecast for April-March 2024-25 to 6.9% from 6.6% previously. This adjustment came when the latest GDP numbers beat estimates according to official government data released on May 31, 2024. India’s gross domestic product (GDP) grew by 8.2% in FY23-24. This compares to growth in fiscal year 2023 of 7%.

Composition of growth factors

“We think there could be some shift in the composition of what drives growth going forward with some softening in urban consumption but rural consumption picking up and the fixed investment side largely maintaining its current momentum,” Varma said.

Also Read | Jio Infocomm May soon go for IPO – Seeking $100 B Valuation – INR 1200/Share

Both economists believe policy continuity after the election is crucial. This is especially important in areas such as capital spending, fiscal consolidation, and macro-financial stability.

Varma believes that reforms are needed. These are in land, and labour markets. They also include the legal system. Bureaucratic processes need improvement as well. Rationalisation of the Goods and Services Tax (GST) is necessary, along with the expansion of the tax base, for India’s productivity and competitiveness.

Economic growth will be less costly

HSBC’s Bhandari highlights several positive factors. A strong credit cycle is particularly notable. The construction cycle is also strong. Growth in services and exports is beneficial. The RBI’s better-than-expected dividend will help stabilise the country’s finances. This makes economic growth less costly.

“My sense is that this RBI dividend is about 1.3 trillion rupees extra money that has been got. About half of it could go into fiscal consolidation. But my sense is the other half will go to welfare spending to basically push up consumption, which is, I think, the need of the hour,” Bhandari said.

Read Also | Housing emergency in Scotland: Strong leadership required to tackle it

Rate cut on the horizons?

The RBI sees a possibility of a rate cut around October. Especially if the monsoon season is good. Food inflation needs to come down. An initial reduction of 25 basis points is expected. A second cut of 50 basis points is quite likely. Bhandari pegs India’s medium-term growth at 6.5%. At the same time, she emphasises that in order to achieve this, it is important to move from reforms of the executive power to legislative reforms.

About Author

This article has been covered by Ms. Swara Kekatpure, a finance student at NMIMS University, Mumbai. She carefully analyses businesses in detail and ensures her work incorporates honesty, integrity, and unwavering dedication.