SBI Eyes $3 Billion Debt Raise in FY24-25

State Bank of India (SBI) seeks to raise up to $3 billion through debt issuance this fiscal year. The funds will be availed in tranches via public offerings or private placements of foreign currency-denominated notes.

Read moreBirlasoft’s Profits Soar: Company Reports 60.7% Jump in Net Profit

Shares of BirlaSoft rose 0.22% to INR 675.80 on the BSE on Monday, while the Sensex closed 1.28% higher at INR 74,671.28. Quarterly results were announced after the market close

Read morePayU Receives RBI’s In-Principle Nod to Operate as Payment Aggregator

PayU Payments powered by Prosus receive in-principle approval from RBI with an emphasis on compliance and governance. It works as a payment gateway, offers buy now pay later services, and competes with Razorpay and PhonePe

Read morePaytm Receives Green Light from NPCI to Shift Users to New PSP Banks

Following the receipt of this NPCI permission, Paytm has quickly started the migration of its users to Payment Service Provider (PSP) banks’ handles

Read moreJio Financial Services Announces Joint Venture with BlackRock: Shares went up by 5%

Jio Financial Services has consistently delivered positive monthly returns from November last year to March this year and its shares saw significant gain, with the scrip trading ..

Read moreAdvertisement

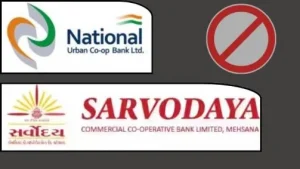

RBI Imposes Restrictions on Sarvodaya Co-operative Bank and National Urban Co-operative Bank

RBI has capped the withdrawals at INR 10,000 for customers of National Urban Co-operative Bank Limited and the withdrawals of INR 15,000 from the account of Sarvodaya Co-operative Bank due to their deteriorating financial health

Read moreAshneer Grover Ventures into Fintech Again with ZeroPe: A Medical Loan App

The New Venture ZeroPe is the Brainchild of Ashneer’s company ‘Third Unicorn’ which earlier launched a fantasy gaming app CrickPe giving competition to players like Dream 11 and MPL

Read moreMuthoot Microfin Reports Impressive Growth in Q4 FY24

The company's collection efficiency (CE) for FY24 stood at an impressive 98.4%, marking a significant improvement of 260 basis points (BPS) from the previous financial year

Read moreIRDAI Expresses Reservations Over IndusInd International Holdings’ Bid for Reliance Capital Acquisition

The IRDAI has also highlighted concerns regarding exceeding the foreign direct investment (FDI) limit in financially distressed Reliance Capital.

Read morePaytm Issues FAQs Amid Closure of Paytm Payments Bank Arm

Users can breathe a sigh of relief as Paytm reassures them that essential services such as Paytm QR codes, Soundbox, card machines, and various financial transactions will remain fully functional.

Read more