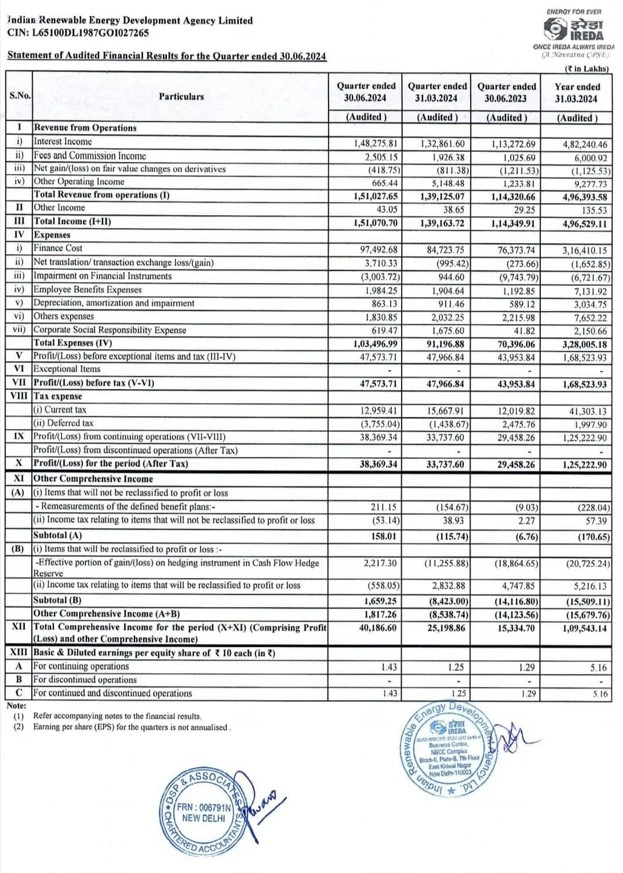

On July 12, 2024, Indian Renewable Energy Development Agency Limited (IREDA) reported impressive financial results for the April-June quarter. The company’s net profit increased by 30%. The profits reached INR 383.69 crore compared to INR 294.58 crore during the same period last year. This is also an improvement over the INR 337 crore profit reported in the March quarter.

Also Read | ‘Aditi’, an affordable health insurance by Narayan Health: Check how this can revolutionize insurance sector

Improved Asset Quality

IREDA’s asset quality has seen positive changes. The Gross Non-Performing Assets (NPA) ratio dropped to 2.19%. This was from the end of June from 2.36% at the end of March. In the previous quarter, the Net NPA ratio improved to 0.95% from 0.99%. IREDA’s debt-equity ratio also showed improvement. It was at 5.83x compared to 6.35x last year.

Loan Sanctions and Disbursements

IREDA has experienced significant growth in loan sanctions and disbursements. For the June quarter, loan sanctions amounted to INR 9,136 crore. This is a very huge increase from INR 1,893 crore in the same period last year. Loan disbursements rose by 67.6% to INR 5,320 crore. IREDA’s loan book reached INR 63,150 crore. This shows a 33.8% growth compared to the previous year.

IREDA Q1 2024-25 Results

Future Plans

IREDA’s Chairman and Managing Director (CMD), Pradip Kumar Das, shared plans for future growth. He said that IREDA is considering raising equity through a Follow-on Public Offer (FPO). It will be worth between INR 4,000 crore and INR 5,000 crore. They are waiting for government approval. The FPO could take place between November this year or February next year.

Also Read | “Bajaj Ki Guarantee” For World’s First CNG Motorcycle: Freedom 125 For The Independent India

Stock Performance

IREDA’s stock has performed well. Shares of IREDA rose nearly 10 times from their IPO price of INR 32. On Friday, July 12, 2024, the IREDA’s stocks hit a new high of INR 304.6. This was before a closing of 0.4% higher at INR 284.65. IREDA is also seeking inclusion under Section 54EC of the Income Tax Act. This could lower its borrowing costs.

Overall, IREDA’s strong financial performance and strategic plans show a promising future for the renewable energy financier.

Disclaimer

The content of this article is only for informational purposes and we do not offer any investment advice from our end. Please consult a SEBI-registered investment advisor before making any investment decision. The information does not necessarily reflect the views/opinions of the publisher.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.