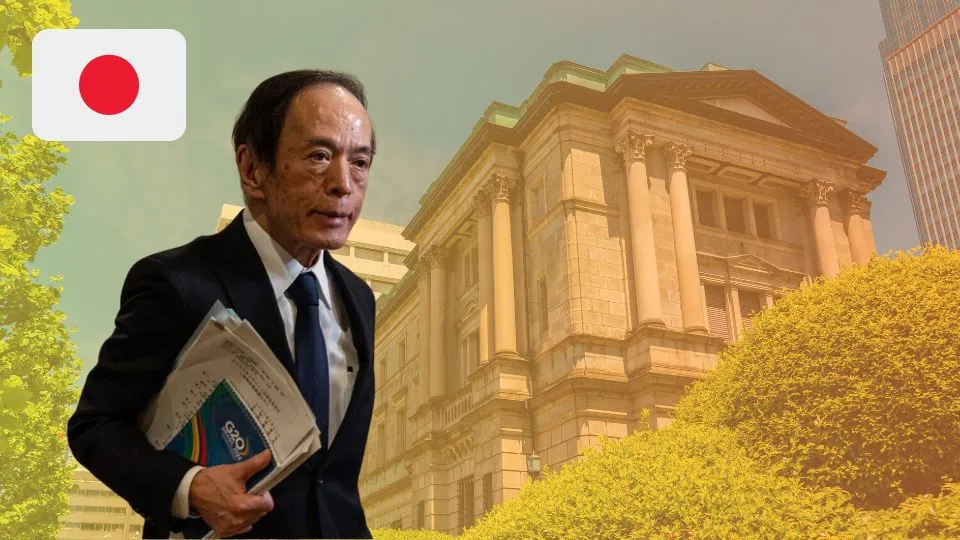

Japan’s central bank has raised interest rates for only the second time in nearly two decades. This decision is expected to help strengthen Japan’s struggling currency. They will reduce the burden on consumers paying more for imported goods like food and energy.

Interest Rate Hike Details

The Bank of Japan increased its target policy rate to 0.25 percent. This is up from the previous range of 0 to 0.1%. The last increase occurred in March. This marked the first-rate hike since 2007.

Impact on the Yen

Over the past two years, the yen has lost value against the dollar due to a significant gap between Japan’s and the United States’ interest rates. However, the yen has recently regained some strength as traders anticipated the Bank of Japan’s rate increase.

Economy and Consumer Spending

The weak yen has impacted Japanese consumers’ spending power and contributed to the shrinking of Japan’s economy in two of the past three quarters. Inflation has exceeded the policymakers’ target of 2 percent for over two years, leading to expectations of another rate hike this year.

Pressure to Act

The Bank of Japan has been under pressure to prevent the yen from sliding further, as an excessively weak yen negatively affects Japan’s economy. Low interest rates have pushed some investors to seek higher returns outside Japan, weakening the yen further.

Effect on Businesses

Japan’s low interest rates, intended to encourage inflation during periods of stagnant prices, have benefited large international corporations but have squeezed consumers and smaller domestic businesses. The government has spent billions to stabilize the yen.

Recent Yen Strength

Recently, the yen has gained strength, trading around 153 to the dollar after the rate increase announcement. Earlier this month, it was at 161 yen to the dollar, showing significant improvement.

Corporate Benefits

A weak yen has traditionally helped Japan’s big exporters by inflating their earnings and making their products more competitive abroad. Companies like Toyota have reported record profits, and Japan’s Nikkei 225 index has hit new highs.

Consumer Challenges

However, the weakened yen has made imports more expensive, raising prices for consumers. Rising costs and expectations of continued high prices have led to reduced consumer spending. Smaller businesses are struggling with both reduced demand and increased costs.

Economic Forecast

While the rate increase might make mortgages more expensive, it is expected to positively impact consumer spending. Consumers are very sensitive to fears that Japan’s weak yen will keep inflation high.

Small Business Perspective

Hiroshi Enomoto, a Tokyo shop owner, has faced increased costs for flour and gas due to the weak yen. He has noticed a decline in customer spending, with people buying fewer of his traditional fish-shaped waffles, Taiyaki.

Economic Reports

A recent report from Mizuho Research & Technologies highlighted the negative impact of the yen’s decline on smaller companies. It warned that these firms struggle to raise wages, which is essential for stimulating consumption and ensuring long-term economic growth.

Also Read: Budget 2024: Government Unveils GST Expansion, Duty Cuts on Essentials and Simplified Tax Regime

Future Outlook

Economists suggest that while the rate increase may not significantly strengthen the yen, it could help close the interest-rate gap between Japan and the United States. The Bank of Japan is likely buying time, waiting for the U.S. Federal Reserve to cut its rates, which could happen later this year.

In summary, the Bank of Japan’s interest rate hike is a significant step towards stabilizing the yen and easing the financial burden on consumers. However, the overall impact on Japan’s economy will depend on various factors, including future actions by the U.S. Federal Reserve.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.