In the Q1 FY25, Jio Financial Services reported a 5.72% drop in net profit. The profit stood at INR 313 crore. As compared to INR 332 crore in the same period last year, it is quite low. Interest income also saw a decline of 19.8%. It had fallen to INR 162 crore from INR 202 crore in Q1 of FY24.

Total Income Sees Marginal Increase

Despite the drop in net profit, Jio Financial Services recorded a slight increase in total income. It reached INR 418 crore. This increase was primarily due to a higher net gain on fair value changes. It rose to INR 218 crore from INR 174 crore in the previous year.

Also Read | Kotak Mahindra Bank Pulled in Adani-Hindenburg Controversy: Check the Saga of Accusations & Clarifications

Introduction of New Financial Products

In July, Jio Finance, a 100% subsidiary of JFS, introduced new financial products. Loans against mutual funds and digital insurance for auto and two-wheeler vehicles were some of the products it launched. JFS plans to expand its offerings to include loans against property and securities in the future. Jio Financial Services also launched the beta version of the “JioFinance App.”

Leasing Services and Payments Bank Expansion

Jio Leasing Services, which is another subsidiary, has begun leasing AirFiber devices. Jio Payments Bank, primarily owned by Jio Financial Services with a minority stake by the State Bank of India, has over one million CASA customers. JPB aims to expand its channels, increase transaction volumes and introduce new cross-sell products.

New Insurance Products on the Horizon

Jio Insurance Broking, the company’s insurance broking arm, is set to launch new digital products. It is also planning to expand its range of embedded insurance offerings. The focus will be on enhancing its digital channel presence.

Also Read | Patanjali Foods shall Acquire Non-Food Business of Patanjali Ayurved for INR 1,100 Crore

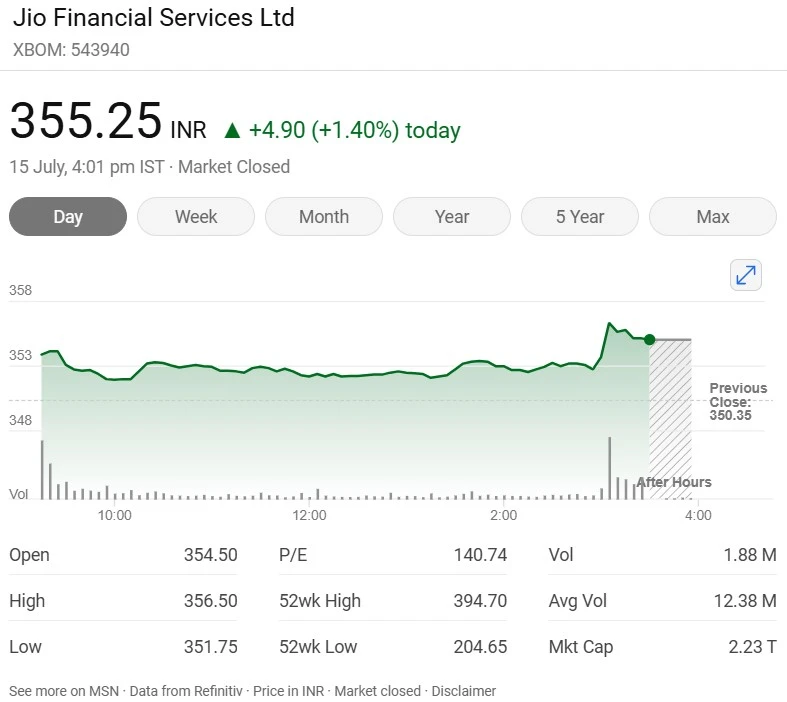

Share Performance

Jio Financial Services shares closed at INR 355.25. It made a 1.40% increase on the BSE.

Analysts’ Rating

Ganesh Dongre, a Senior Manager of Technical Research at Anand Rathi, provided insights on the technical outlook for Jio Financial Services’ share price. He said that the stock is close to breaking out at the INR 260 level. If it surpasses this point, the Reliance Group stock could reach a new high. The high will be of the INR 290 to INR 295 range. Dongre advises current shareholders to hold onto their shares with a stop loss set at INR 205. Should the stock decisively break above INR 260. Investors can adjust their trailing stop loss to INR 240. They can aim for a near-term target of INR 295.

For potential new investors, Dongre suggests waiting for the breakout. Once the stock moves past INR 260, it would be a good opportunity to buy. He targets INR 295 in the near term and maintains a stop loss of INR 240.

Disclaimer

The content of this article is only for informational purposes and we do not offer any investment advice from our end. Please consult a SEBI-registered investment advisor before making any investment decision. The information does not necessarily reflect the views/opinions of the publisher.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.