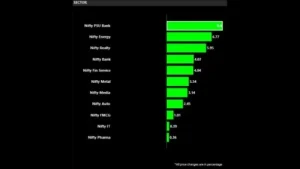

On June 3, 2024, the Indian stock market celebrated a greater pre-victory than the NDA. As the exit polls came in favour of the NDA, all the Indices, including Nifty, Banknifty, Midcap Nifty, Sensex & Bankex hit a new all-time high. Indices of all the 13 sectors were in green, with financial services, oil and gas, and power sectors leading the charge on the Nifty index.

Market Performance

When even the seasoned traders were expecting Nifty 50 to reach 23,000 after elections, Nifty 50 today saw the record breaking high of 23,338. Sensex saw an unprecedented high of 76,738. During the closing bell, the Sensex had rose by 2,507 points (3.4%) to reach 76,468 and the Nifty 50 had gained 733 points (3.3%) to stand at 23,263.

In the broader market, there was a rise of 3.5% in BSE Midcap whereas BSE Smallcap gained approximately 2%. The PSU Banks were the top performer amongst all the sectoral indices with an outperforming growth of 8.6%. Nifty Oil & Gas and Nifty Realty were like Amit Shah to the Narendra Modi. Along with the PSU Banks, both these sectors increased by 7% and 5.7%, respectively.

Effect on Indian Economy

Every analyst in the stock market has his or her own interpretation. Some say the biggest puller was Reliance, some say that it was Adani. But, most of them say it was BJP under Modi. India’s GDP growth exceeds estimated GDP of 8.2 % for FY24. There is a reduction in the fiscal deficit. The early monsoon will play a negative role in the market keeping it less volatile with low movements.

There is a 10 % rise in GST collections which amounts to INR 1.73 lakh crore in May, 2024. The optimistic exit poll results and traders are predicting a third term for PM Modi and BJP, further fuelled investors’ confidence.

Sector Highlights

The banking sector was at its all-time high. Bank Nifty crossed its 51,000 mark for the first time by hitting an all-time high of 51,133. It closed at 51,097 which was 4.3% higher. Bank of Baroda (BoB) led the sector with 12% increase, followed by State Bank of India (SBI), which rose by 9.5 %. Other gainers in Bank Nifty includes Axis Bank, IndusInd Bank, and Punjab National Bank, which saw a substantial increase in its prices between 4% to 6%.

In the Nifty 50, NTPC, SBI, and Adani Ports were the top gainers, each rising between 9.3 and 10.6%. Likewise, HCL Tech, LTI Mindtree, and Eicher Motors were among the worst performers, with declines of 0.6 to 1.3%. Eicher Motors reported a 1.3% drop following a decline in motorcycle sales in May.

Market Outlook

Experts believe that if the exit poll results are confirmed by the actual election outcome, the market could see new highs. Santosh Meena, the Head of Research at Swastika Investmart, suggested that Nifty could move above 23,500, which it did before the results. He also said that Sensex would gradually move towards 77,000. Alok Jain, Founder of Weekend Investing, said that markets are showing strong faith in the Modi’s Win and his leadership. This could be a great potential for India to emerge as one of the fast-growing and developed nation.

Puneet Maheshwari who is a Director at Upstox, said that advancement in technology and increased retail participation have significantly contributed to the market taking upswings. Ashish Kumar, Founder of StoxBazar, highlighted the positive movement driven by the exit polls and predicted a continuance of the current government.

About Author

This article has been written by Mr Radhesh Tarang Shah, who is a third-year management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.