On July 1, 2024, Patanjali Foods Limited announced that it will acquire the non-food business from Patanjali Ayurved Limited (PAL) for INR 1,100 crore. Patanjali Foods Limited is known for its edible oils and related products amongst the Indians. This acquisition includes PAL’s hair care, skin care, dental care, home care products and all the other related assets & liabilities.

Stock Market Reaction

Following the announcement, shares of Patanjali Foods Limited saw a significant increase. They closed at INR 1,699.65 on the Bombay Stock Exchange (BSE). This was up by INR 108.30 or 6.81%.

Also Read | Xerox Partners with TCS for Cloud and AI Transformation: Check what happens next

Board Approval and Necessary Permissions

The board of directors of Patanjali Foods approved the deal on July 1, 2024. This acquisition still requires approvals from shareholders, lenders and regulatory authorities.

Business Operations

The non-food business, which is being acquired, is operated from the manufacturing plant at Patanjali Foods & Herbal Park in Haridwar, Uttarakhand. For the FY ending on March 31, 2024, PAL reported a turnover of approximately INR 6,199 crore.

Related Party Transaction

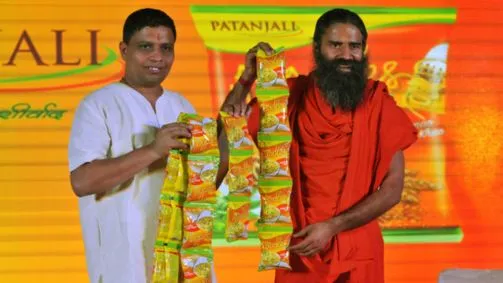

This acquisition is considered a related party transaction. This is because PAL is a promoter of Patanjali Foods. Key individuals involved include Ram Bharat, Managing Director of Patanjali Foods and Acharya Balkrishna, Chairman of Patanjali Foods.

Expansion into FMCG Sector

The acquisition will help Patanjali Foods expand its product portfolio in the fast-moving consumer goods (FMCG) industry. The transaction requires approval from the Competition Commission of India (CCI) and shareholders.

Payment Structure

The total acquisition amount of INR 1,100 crore will be paid in tranches. The first tranche of INR 220 crore will be paid within 10 business days of receiving approvals from the CCI, shareholders and lenders. The final tranche of INR 55 crore will be due upon the conveyance of all properties related to the business.

Also Read | Is Titan going For 1100% Dividend Pay-out: Highest since 2010

Licensing Agreement

Not just the acquisition, but Patanjali Foods will enter into a licensing agreement with PAL to use its intellectual properties. This agreement will require Patanjali Foods to pay a license fee of 3% of the gross sales value of the products. There will be a minimum yearly payment of INR 83 crore.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.