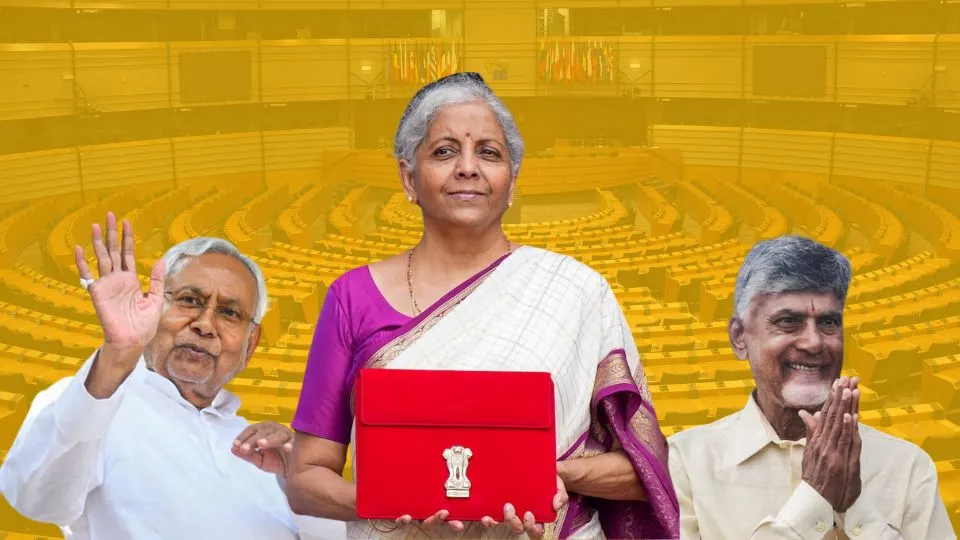

The Reserve Bank of India (RBI), on Friday 5th April 2024 announced that it would maintain the key policy repo rate at 6.5% marking the 7th consecutive time the Rate has remained unchanged. The decision came as a part of the first monetary policy review for the financial year 2024-25, with the RBI Governor, Shaktikanta Das, emphasizing a continued policy stance of ‘withdrawal of accommodation’.

Continuation of Policy Amid Favourable Economic Conditions

The Reserve Bank’s decision to maintain the policy rate was mostly expected by the investors and economists who deemed inflation and the strong growing economy of India as key reasons for it. However, there is an unresolved mystery of price growth, which is uncontrolled in the food sector. Nevertheless, the RBI expresses confidence that inflation will reach the target level of 4% soon.

Also Read | Shapoorji Pallonji Group’s Construction Arm Afcons Infrastructure Files DRHP to SEBI for INR 7000 Cr IPO

Key Highlights of the RBI MPC Outcome

The RBI’s decision to keep policy rates and stance unchanged was largely expected, with analysts and economists citing India’s strong economic growth and persistent inflation as key factors. The Monetary Policy Committee (MPC) of the RBI voted 5:1 in favour of keeping key rates on hold. At 6.5%. Additionally, the Standing Deposit Facility (SDF) rate, Marginal Standing Facility (MSF) rate and Bank Rate will also remain unchanged.

GDP Protection of RBI

RBI has projected a real GDP growth of 7% for FY25, with favourable prospects for agriculture and rural activities. But inflation is now receding at a pace that makes the RBI highly vigilant over the possible supply shocks anywhere especially in the food sector. The FY25 Consumer Price Index (CPI)-based inflation (annual rate) is expected to be 4.5%, and quarterly changes are probably going to be observed.

Trading of Green Bonds

Moreover, RBI will introduce a scheme for financial institutions and trading participants to invest and trade in sovereign green bonds at the International Financial Services Centres (IFSCs) and to attract more non-residents into the domain of such bonds. Despite ongoing concerns over inflation, especially food prices, the RBI remains firm on its commitment to bring inflation below 4%.

A comprehensive review of the liquidity coverage ratio (LCR) framework is on the horizon, with a draft circular to be issued for stakeholder consultation. Governor Das highlighted the need for this review in light of technological advancements and changing banking dynamics.

Also Read | Apple’s Participation in India’s PLI Scheme Creates Over 1,50,000 Jobs: Report

Outlook and Post-Policy Insights

Governor Das laid greater emphasis on the need to care alertly about the fluctuations of prices of food products, especially since April till June are the months of higher temperatures. Moreover, as the deflationary effect of lower oil prices is set to grow stronger going forward, inflation will be further pressed.

At the post-policy press conference, Deputy Governor MD Patra of RBI disclosed no changes to the central bank’s Exchange Fixed Income risk monitoring policies upon queries regarding exchange-traded currency derivatives.