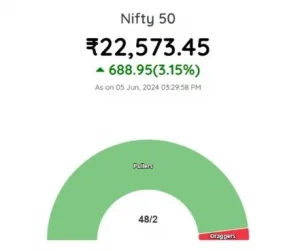

The Indian stock market experienced a significant rebound on Wednesday, June 5, 2024. Both the Sensex and Nifty 50 increased over 3%. This recovery comes a day after the markets faced their biggest single-day fall losses in nearly four years.

The Sensex surged by 2,303 points or 3.20%, close at 74,382.24. The Nifty 50 increased by 736 points or 3.36%, to end at 22,620.35. This sharp rise was mainly due to the investors reassessing the Lok Sabha election results. They were focusing on underlying market fundamentals and developments regarding the formation of the government.

Big Win for BJP-Led NDA suggests D-Street

The stock market’s recovery showed a huge sign that the BJP-led NDA is likely to form the government at the Centre. This helped boost investor’s confidence. Comments from leading brokerage firms like Motilal Oswal Financial Services Limited suggested that the election results were a short-term market trigger without significant long-term impact.

Sectoral Indices and Stock Performances

All the sectoral indices on the NSE ended with substantial gains. Nifty Metal and Private Bank Indices led the rally by rising over 5%. Other significant gainers jumping over 4% included the Nifty Bank, Auto, Financial Services and FMCG indices.

Adani Ports emerged as the top gainer in the Nifty 50 with a 7.29% increase. IndusInd Bank and Hindalco followed Adani Ports closely, rising by 7.06% and 6.46%, respectively. Nearly 120 stocks, including giants like Mahindra and Mahindra, Bajaj Auto, and Britannia, hit a fresh 52-week high during the intraday session on the BSE.

In contrast to yesterday’s trading session, only two stocks in the Nifty 50 ended in the red. They were Larsen and Toubro which was down by 0.10% and BPCL which was down by 0.03%.

Broader Market Performance

The overall market capitalization of the BSE listed companies increased from INR 395 lakh crore to INR 408 lakh crore. This enriched the investors by approximately INR 13 lakh crore in a single-trading session. This rally was broad-based as large-cap stocks, mid-cap indices and small-cap indices posted strong gains. The BSE Midcap index rose by 4.41% while the Small-cap index surged by 2.93%.

Market Outlook

Market’s attention now turns towards the Reserve Bank of India’s (RBI) ongoing monetary policy meeting. The RBI’s Monetary Policy Committee (MPC) began its three-day meeting on June 5, 2024, with the decision expected on Friday, June 7. Market experts widely anticipate that the RBI will maintain the current repo rate and have a similar policy stance.

Stay tuned for further updates on Monetary Policy Meeting / Outcomes.

Disclaimer

The content of this article is only for informational purposes and we do not offer any investment advice from our end. Please consult a SEBI-registered investment advisor before making any investment decision. The information does not necessarily reflect the views/opinions of the publisher.

About Author

This article has been written by Mr Radhesh Tarang Shah, who is a third-year management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.