Investors are often facing a dilemma of the choice between Sovereign Gold Bonds (SGBs) and physical gold. For that one should consider factors like safety, returns, costs and tax benefits. Having a balanced proportion of both investments can be excellent diversification for your portfolio.

The Age-Old Appeal of Gold Investments

Gold has long been a favoured investment for its returns and safekeeping. Traditionally, Indians have invested in physical gold. This is because of its property of appreciating its tangible form. However, with changing times, Sovereign Gold Bonds (SGBs) are becoming a popular choice due to their convenience and government backing.

Understanding Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) are government-issued bonds equivalent in value to physical gold. They offer a way to own gold without physically holding it. When you purchase SGBs, you lend money to the government and, in return, receive interest along with the gold’s value upon maturity.

Characteristics of Sovereign Gold Bonds

- Guaranteed Purity and Safety: Issued by the Government of India, SGBs ensure the highest purity and are securely stored with the Reserve Bank of India.

- Earn Fixed Interest: SGBs provide a fixed annual interest rate of 2.50%, paid semi-annually, boosting your returns.

- Liquidity: SGBs are listed on exchanges, allowing easy buying and selling before maturity.

- Capital Gains Tax Exemption: Holding SGBs until maturity exempts you from capital gains tax on redemption proceeds.

- Reduced Risk of Gold Price Volatility: The redemption price of SGBs is based on the average gold price over three days before redemption, offering protection against price volatility.

The Tangibility of Physical Gold

Physical gold includes bars, coins, and jewellery. It has been valued for its aesthetics and as a tangible asset. Owning physical gold provides a sense of security and control, adding a sentimental dimension to your investment.

Characteristics of Investing in Physical Gold

- Tangible Asset: Physical gold gives direct ownership, allowing you to hold and store it as you wish.

- Hedge Against Inflation: Gold maintains its value over time, acting as a hedge against inflation.

- Portfolio Diversification: Adding physical gold diversifies your portfolio, providing stability during market downturns.

- Liquidity: Physical gold can be sold through dealers or pawnbrokers, offering quick cash access when needed.

- Cultural Significance: Gold holds cultural and emotional value, often passed down as family heirlooms.

- No Counterparty Risk: Unlike SGBs, physical gold’s value is intrinsic, independent of any third party.

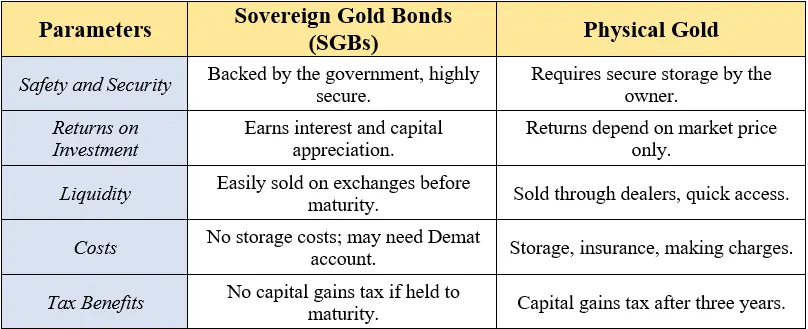

Comparing Sovereign Gold Bonds and Physical Gold

Understanding the differences between SGBs and physical gold helps in making informed investment decisions. Who Should Consider an STP?

Advantages of Sovereign Gold Bonds

- Term of Bond: SGBs have an 8-year term with an assured interest rate, but premature redemption is possible.

- Safe Investment: Dematerialized SGBs avoid risks of loss, purity issues, and making charges associated with physical gold.

- Minimal Price Loss Risk: SGBs are priced close to market value without additional charges.

- Accessible to All: SGBs are available to all investors within specified limits.

- Online Purchase Discount: Online purchases of SGBs are cheaper by INR 50 per gram.

- Loan Against SGBs: SGBs are accepted as collateral by lending institutions.

- Tax Benefits: Capital gains from SGBs are tax-exempt.

Disadvantages of Sovereign Gold Bonds

- Less Liquidity: SGBs have a lock-in period of 5 years and involve a redemption process.

- Price Volatility Risk: SGBs are subject to market price fluctuations.

- Redemption Process: Redemption prices are averaged over three days, possibly resulting in slight losses.

Pros and Cons of Physical Gold

Pros

- Direct Ownership: Provides control and security.

- Inflation Hedge: Maintains value over time.

- Portfolio Diversification: Balances investment risk.

- High Liquidity: Easily sold for quick cash.

- Cultural Value: Holds emotional and cultural significance.

- Intrinsic Value: No reliance on third parties.

Cons

- Storage Costs: Requires secure storage.

- Insurance Costs: Needs to be insured against theft or loss.

- Making Charges: Includes additional charges for jewelry.

- Purity Concerns: Requires verification of purity.

- Capital Gains Tax: Taxable after three years.

Diversify for the Best of Both Worlds

Choosing between SGBs and physical gold depends on individual preferences and financial goals. Both investments have their advantages. SGBs offer safety, interest and tax benefits. Whereas physical gold provides tangibility, cultural value and a hedge against inflation. Diversifying your portfolio with a mix of both can provide security and tangible value, ensuring a balanced and resilient investment strategy.

Ultimately, the decision lies with you. Carefully consider your needs, conduct thorough research and consult a financial advisor to make the best gold investment for your strategy. Investing in gold, in any form, continues to be a timeless and valuable choice.

Disclaimer

The content of this article is only for informational purposes and we do not offer any investment advice from our end. Please consult a SEBI-registered investment advisor before making any investment decision. The information does not necessarily reflect the views/opinions of the publisher.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.