Starting a new business requires more than just a great idea; it needs funding. Start-ups need funding to transform innovative ideas into viable businesses. Start-ups require funding support for activities such as product development, market research, hiring talent and scaling operations. Without adequate capital, start-ups struggle to compete, grow and achieve long-term success in their industries.

Various types of start-up capital help businesses launch and grow. This article explores different funding stages, from pre-seed to Series D+ and non-series funding options like venture capitalists, incubators, angel investors and more.

Series Funding Stages

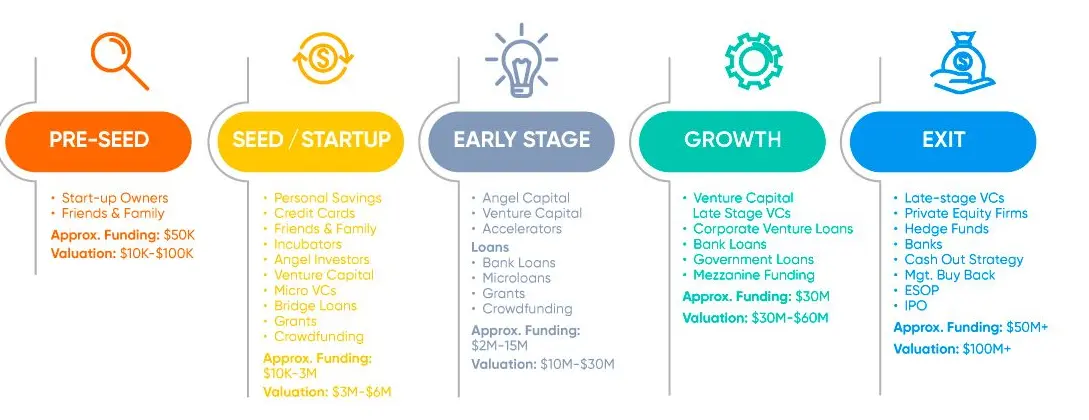

Pre-seed Funding

Pre-seed funding is the initial phase where founders use personal savings or funds from friends and family to get started. Typically, start-ups raise around USD 600,000 at this stage. This funding is used to develop the idea and create a foundation for the business. For example, companies like Ola and OYO Rooms started with pre-seed funding from family and friends.

Seed Funding

Seed funding helps start-ups with market research and product development. At this stage, start-ups typically raise about USD 2.9 million. Investors include friends, family and sometimes venture capitalists. Seed funding helps businesses establish themselves and prepare for future growth. Paytm, an Indian digital payment platform, received seed funding to develop its initial product.

Series A Funding

Once a product gains traction, start-ups move to Series A funding, raising around USD 11.6 million. This funding supports expanding the product or entering new markets. Investors expect a solid business plan showing potential for significant profits. Flipkart, an Indian e-commerce giant, raised Series A funding to expand its operations.

Series B Funding

Series B funding helps start-ups scale to meet growing demand. Start-ups raise approximately USD 30 million at this stage to hire industry leaders, expand advertising and grow sales teams. Zomato, a restaurant aggregator, used Series B funding to scale its business and enter new markets.

Series C Funding

Series C funding, usually around USD 60 million, is for horizontal expansion like acquiring other businesses or developing new products. This stage is less risky as the start-up has proven growth and revenue. Swiggy, a food delivery service, used Series C funding to acquire smaller companies and expand its services.

Series D Funding

Series D funding, which can reach USD 105 million, is rare and usually for start-ups that didn’t meet their profit expectations in Series C. Series E funding is an alternative to going public. Paytm Mall used Series D funding to push growth after initial market challenges.

Non-Series Funding Sources

Venture Capitalists

Venture capitalists (VCs) are private investors who buy equity in start-ups, usually at Series A or later stages. They expect high returns as the business grows. In India, Sequoia Capital and Accel Partners are prominent VCs investing in promising start-ups like BYJU’S.

Incubators and Accelerators

Incubators and accelerators support early-stage start-ups with resources like office space and mentorship. Incubators are often non-profits, while accelerators usually take equity in exchange for their services. The Indian government’s Start-up India initiative offers incubation programs to nurture new businesses.

Angel Investors

Angel investors are high-net-worth individuals who fund start-ups at early stages. They provide not only capital but also expertise and business connections. Ratan Tata, former chairman of Tata Sons, is a well-known angel investor in Indian start-ups like Ola and Urban Ladder.

Small Business Loans

Small business loans, backed by the Small Business Administration (SBA), offer USD 500 to USD 5 million to start-ups with fewer than 500 employees. In India, schemes like Pradhan Mantri Mudra Yojana provide loans to small businesses, helping them grow without giving up equity.

Equity-free Financing

Platforms like Republic and Pipe offer equity-free financing, allowing start-ups to secure funding without sacrificing ownership. For example, Razorpay, an Indian fintech company, raised funds through such platforms to maintain control while expanding its operations.

Additional Funding Options

Bootstrapping

Bootstrapping involves using personal savings and initial sales revenue to fund the start-up. Zoho, an Indian software company, is a successful example of bootstrapping, growing without external funding.

Friends, Family, and Fools (FFF)

Around 35-40% of start-ups receive capital from friends, family, and fools. This early-stage funding relies on personal networks and trust. For instance, Snapdeal’s early funding came from personal networks before attracting larger investors.

Public Funds

Public funds from government programs support start-ups with grants and loans. Initiatives like the ATAL Innovation Mission and Qualcomm Semiconductor Mentorship Program offer financial assistance to Indian start-ups, promoting innovation and growth.

Crowdfunding

Crowdfunding raises small amounts from many people to fund a project. Indian start-ups like Ketto and Wishberry have successfully used crowdfunding to bring their ideas to life.

Bank Financing

Traditional bank loans provide start-ups with necessary capital but require meeting strict conditions and offering guarantees. Banks like State Bank of India and ICICI Bank offer various financing options for start-ups.

Venture Capital

Venture capital funds invest in high-growth potential start-ups in exchange for equity. Tiger Global and SoftBank are notable VCs in India. They have invested in companies like Paytm and OYO Rooms.

Private Equity

Private equity funds invest larger amounts in established companies with growth potential. Unlike venture capital, private equity targets more mature businesses. KKR and Blackstone have made significant investments in Indian companies.

Leasing

Leasing allows start-ups to rent equipment instead of buying, preserving cash flow. Indian start-ups often lease equipment to avoid large upfront costs and maintain flexibility.

Also Read: Budget 2024: Government Unveils GST Expansion, Duty Cuts on Essentials and Simplified Tax Regime

Factoring or Invoice Discounting

Factoring provides immediate credit to start-ups selling on credit terms. Fintech companies like KredX and Indifi offer invoice discounting services, helping start-ups manage cash flow effectively.

Understanding the various types of start-up capital is crucial for entrepreneurs looking to launch and grow their businesses. From pre-seed to Series D+ funding and non-series options like venture capital, incubators, and small business loans, each funding type offers unique benefits. By exploring these options, start-ups can secure the necessary capital to succeed in the competitive business landscape.

About the Author

Mr. Radhesh Tarang Shah, is a management student at Institute of Management, Nirma University. He has a passion for writing articles and poems. He has experience as a financial analyst, author, news writer, marketer and social worker.